In getting ready to file your 2015 taxes, truck drivers need to sit down with their log book and figure out just how many meals they are eligible to claim on their taxes.

In getting ready to file your 2015 taxes, truck drivers need to sit down with their log book and figure out just how many meals they are eligible to claim on their taxes.

We’ll give you the basics in this article, but if you’re needing more information on claiming meals and lodging expenses, check out the links we’re sharing.

What Truck Drivers can Claim

Long-haul truck drivers can deduct 80% of their claim; if you’re not a long haul truck driver you can deduct 50% of your claim.

Not sure if you’re classified as a long haul truck driver? Check out the CRA Meal Expenses of Long-haul Truck Drivers to determine your status.

The daily meal rate for all truck drivers is $17 (including taxes) per meal, for a max of three meals a day. Canada Revenue Agency states that, for the purposes of calculating the maximum number of meals allowed, a day is considered to be a 24-hour period that begins at the departure time.

Using the Simplified Method

The simplified method is the easiest way to calculate your meal expenses since you do not have to keep receipts for your meals and your log book provides all the information you will need.

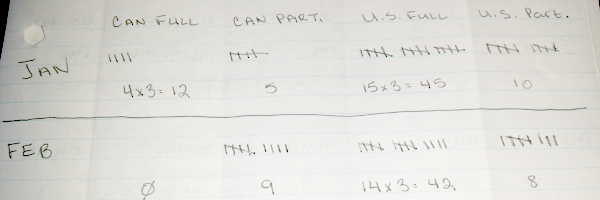

Step #1 Set up a tally sheet to help you stay organized. There is nothing worse than getting half way through this undertaking, messing up and having to start from the very beginning. One method that works well is setting up a tally sheet that separates months, Canadian Full Days, Canadian Partial Days, U.S. Full Days and U.S. Partial Days, as shown below. (Note: you get to claim an exchange rate for U.S. meals, so it’s important to separate and know how many U.S. meals you can claim.)

Starting with January 1, 2015, start calculating the days and tallying them on your sheet. Each full day will then be multiplied by 3 to get the total meals. For the partial days, simply make a tally of the number of meals.

For example, you’re heading back to Winnipeg and start your day in Fargo. You’ll be home before lunch, but get to claim 1 meal for breakfast in Fargo. Under the U.S. Partial, you would mark a tally of 1.

Step #2 Determine your total Canadian and total U.S. meals. Once you have all your tallying complete, don’t forget to multiple full days by 3 to get the number of meals for those complete days, add them up. You will now have a total for Canadian Meals and a total for U.S. meals.

Step #3 Determine your total claim and deductible amount. Take the number of Canadian meals and multiply by $17.00. Take the number of U.S. meals and multiply, first by $17.00 and then by 1.27871080 to adjust for the U.S. exchange rate. These two totals are your claim amounts.

Note: the exchange rate amount differs by year and is based on an average. The exchange rate used on your taxes must be obtained through the CRA website.

Add your Canadian Claim and U.S. claim together and multiply by 80% to determine your deductible amount. This final total is your deductible amount.

For example: Our driver is claiming 205 Canadian Meals and 595 U.S. Meals:

- 205 x $17.00 = $3,485

- 595 x $17.00 = $10,115 x 1.27871080 (U.S. Exchange) = $12,934

- Total Claim = $16, 419

- Long-haul truck drivers can deduct 80% ($16419 x 80%) = $13,135

Step # 4 Fill out all the information on Form TL2, Claim for Meals and Lodging Expenses following the instructions provided on the form.

Lodging and showers can also be deducted on Form TL2, but you must be able to provide receipts for these two items and you must calculate any contributions your employer made towards these items. If your company paid for that hotel room, you can’t write it off.

If you have any questions about claiming Meals and lodging check out the CRA website. It provides a lot of useful information to get you started. The benefits of going through these steps and claiming your Meals and Lodging far outweigh the headache of going through a year of log books.