If you’re new to truck driving you many not be aware that you can also claim meals and lodging expenses. Currently Canadian Truck Drivers can claim $17.00 per meal, per day that they are over the road. If you are a long haul truck driver 80% of your meal claim will be deducted from your total income. All you have to do is tally up your meals from your log book and fill out the Claim for Meals and Lodging Expenses (form T2L) when completing your taxes.

It’s not as cut and dry as simply counting up the days you were away and multiplying by 3. You’ll have to look at each day and tally the meals.

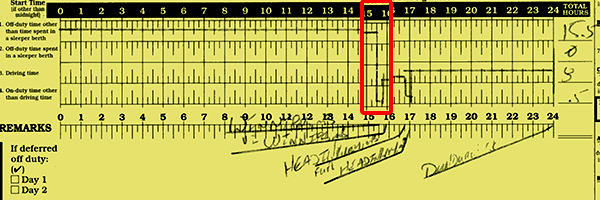

For example:

Our driver left his home terminal at 3:30. It is assumed that breakfast and lunch were eaten at home before he left for his trip. However, he was over the road for dinner and can therefore count this towards his meals.

We are in no way tax experts and suggest that you seek information from professionals when filing your taxes. You can also get more information from Revenue Canada’s Website. The information regarding Employment Expenses and the Claim for Meals and Lodging can be found here.

Len Dubois Trucking is a family-run transportation and trucking company in Winnipeg, Manitoba. We are looking for quality Owner/Operators and company drivers. Join our team today.

Image courtesy of freedigitalphotos.net